Clare Griffiths looks at how planned improvements to the Bank of England’s Real-Time Gross Settlement infrastructure could help streamline property transactions for both solicitors and their clients

Innovation and technology are changing the way we think about payments. There are many ways to make a payment, from contactless debit cards to phone apps. This article provides an introduction to how payments work today, and explains how the Bank of England (the Bank) is exploring new ways to make payments which could change the way property transactions work.

How payments work

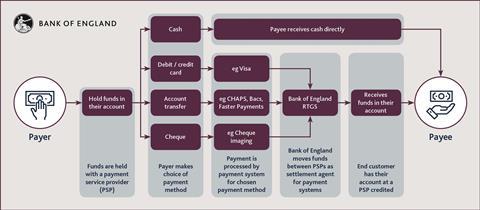

Unless paying by cash, making a payment will involve an electronic transfer of funds across accounts. As figure 1 illustrates, there are several parties involved in this process: the payer (an individual or business); payment service provider (PSP); payment system; and settlement agent.

PSPs offer payment services to customers (individuals, businesses or other organisations such as government) and include credit institutions (banks, building societies and credit unions), and electronic money and payments institutions. Customers can also hold funds in an account at a PSP that they can use to make payments.

A payment system enables money to move from one account to another. Payment systems are managed by a payment system operator which sets the rules and standards; most are supported by one or more providers of hardware, software and communication networks. In the UK, we have a number of payment systems offering different features and benefits. Examples include CHAPS, Bacs and Faster Payments. The differences between these three systems are explained further below.

The Bank acts as settlement agent for sterling payment systems (and has been doing so since the 19th century). To enable this role, the Bank operates the Real-Time Gross Settlement (RTGS) infrastructure, which holds central bank settlement accounts for PSPs.

The balances in these accounts can be used to move money between PSPs’ accounts with the Bank, delivering final and risk-free settlement of obligations to each other.

CHAPS, Bacs and Faster Payments

The three payment systems that can be used for the electronic transfer of funds between accounts are CHAPS (operated by the Bank), Bacs and Faster Payments (both operated by Pay.UK).

CHAPS is a same-day payment system for critical and time-sensitive payments and is used for wholesale, commercial, corporate and retail payments (such as house and car purchases). There is no limit on the size of a CHAPS payment. Settlement is on a gross basis for each payment submitted. It is available Monday to Friday from 6am to 6pm (5.40pm for customer payments, although earlier deadlines may be set by PSPs for some channels).

Bacs is a bulk system for high-volume, regular retail payments. Bacs processes direct debits (such as utility bills) and direct credits (such as payroll). The maximum payment is £20m. Settlement of net payment obligations happens once a day. It is open for submission 24 hours a day, seven days a week.

Faster Payments provides near real-time payments 24 hours a day, seven days a week. It is used for various types of payments including online and telephone banking, as well as standing orders.

The maximum payment is £250k (although some PSPs may set a lower limit for their customers). Settlement of net payment obligations happens three times a day.

What’s changing and how could it affect property transactions?

The Bank is renewing RTGS to develop a service which is fit for the future; increases resilience and access; and offers wider interoperability, improved user functionality and strengthened end-to-end risk management. As well as replicating the functionality provided today, the new RTGS service will deliver a range of new features and capabilities.

One of the proposed new capabilities is synchronisation. At the heart of synchronisation is the concept of “atomic settlement”. This means that the transfer of two (or more) assets – one of which is a payment in RTGS – is linked in such a way as to ensure that the transfer of one asset occurs if – and only if – the transfer of the other asset (or group of assets) also occurs. So the outcome of synchronised settlement is either all parties successfully exchanging assets, or no transfer taking place.

This service would be facilitated by a third party “synchronisation operator” (SO). The SO would introduce transactions into RTGS, ‘earmarking’ funds in PSPs’ accounts in anticipation of the transaction, and then controlling their release when all necessary conditions are satisfied. The SO would also be responsible for interacting with the other ledger if the transaction involves the sale / purchase of another type of asset, and for providing updates on the transaction to all parties.

Why the change?

Taking a housing transaction as an example, synchronisation could allow all payments related to a transaction (such as the purchase price, fees and stamp duty land tax), together with the transfer of ownership on the land register, to be linked together. And, crucially, the payments could be made directly through RTGS, rather than as multiple transfers via solicitors’ client accounts. So the solicitor could instruct fund movements via the SO, and they would all settle across RTGS simultaneously without the solicitor needing to hold the money in the client account. This could improve the speed and efficiency of transactions, as well as reducing the level of costs and risks.

As part of its work on synchronisation, the Bank has been engaging with a wide range of organisations, including stakeholders in the housing market, including the Law Society, Solicitors Regulation Authority, HM Land Registry and the Ministry for Housing, Communities & Local Government. The Bank is aware of the significant amount of innovation taking place in the housing purchase process. Synchronisation could allow further innovation in this space, focused on the efficiency of the payment. To continue to develop this work, the Bank wants to hear from organisations interested in discussing synchronisation further. More information about how to get in touch, and information on the RTGS Renewal Programme, can be found on the Bank of England website. You can also sign up to receive updates on the latest developments.