The benefits and importance of capital allowances in commercial sales and purchases has been well publicised, but did you know the relief also needs to be considered in some residential and landlord and tenant matters? Sophie Raniwala explains

Tax has never been more political. As tax schemes become less palatable, capital allowances become even more attractive, providing a ‘vanilla’ form of assured tax saving that has been around for more than 100 years. Recent Organisation for Economic Co-operation and Development (OECD) restrictions on interest tax relief and restrictions on losses carried forward make these allowances even more attractive and valuable to clients. However, it is frequently under-claimed – or worse, ignored.

This article provides guidance on capital allowances within commercial sale and purchase contracts, and also looks at some often-missed areas of capital allowances, in residential property and landlord and tenant agreements.

The basics

Capital allowances are tax relief on capital expenditure generated when an individual, company or partnership builds or acquires commercial property. ‘Capital’ expenditure means that it is not available to developers. Capital allowances relief is set against taxable profits, so it does not normally apply to non-taxpayers (such as charities and pension funds). It can be on freehold or leasehold expenditure and applies to both UK and overseas investors. Generally, capital allowances can only be claimed on commercial properties, but there are exceptions, as discussed later in this article.

Capital allowances do not apply to all capital expenditure. It must be spent on ‘plant and machinery’ as detailed in case law and part 2 of the Capital Allowances Act 2001 (CAA 2001). The tax relief is spread over time on a writing down basis, at 100 per cent first year allowance for green plant and machinery, 18 per cent per annum for general pool plant and machinery, and eight per cent per annum for special rate pool plant and machinery.

The allowances provide tax relief, so clients that currently have losses may not wish to spend time and money claiming capital allowances. However, there is an opportunity to revisit capital allowances once the client is tax-paying, and make claims in an open tax return, as long as they still own the plant and machinery.

Some of the items that qualify for general pool include sprinklers, carpet tiles and sanitary ware. A list can be found in section 23 of the CAA 2001, but case law constantly provides further guidance on what can and cannot be claimed. In April 2008, the integral features pool was introduced, which expanded the items of plant and machinery which could be claimed, to include electrical lighting and general power systems, cold water systems, external solar shading and thermal insulation to an existing building.

Property purchases

Capital allowances are available for not only construction projects, but also purchasing properties, and this is particularly important to solicitors. The capital allowances fixtures legislation allows for apportioning part of the purchase price of a property to the plant and machinery within that building. Depending on the type of property and claims made by previous owners, the value of the capital allowances can be as much as 40 per cent of the property price. For individuals paying 45 per cent tax, this can be a huge saving, and even at the 19 per cent rate for corporates, this is a large value to be ignored. A tax election under section 198 of the CAA 2001 is used to state the quantum of allowances that is to be passed from the buyer to the seller.

The change in fixtures legislation from April 2014 means capital allowances must now be considered well before the sale and purchase contract is agreed. The 2014 fixtures rules advise that if the seller is chargeable to tax and could have claimed capital allowances, the allowances must be pooled and passed on via a section 198 tax election in order for the purchaser to benefit (sections 187A-187B of the CAA 2001).

At heads of terms stage, the client needs to state their preferred capital allowances position: a vendor may want to retain all the allowances on sale, while a buyer may aim to persuade the vendor to claim and transfer all available allowances.

Specialist capital allowances advice should be sought when completing the capital allowances queries as part of the Commercial Property Standard Enquiries (CPSE). If allowances are not considered, they are lost not only for the buyer of the property, but also for all future buyers.

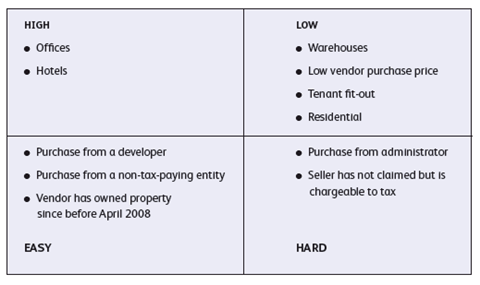

If acting for a buyer, the potential quantum of allowances should be considered before a strategy of persuading the vendor to pool and transfer the allowances is pursued – the exercise is significant, and may not be worth it if the allowances would provide negligible value to the client. The table opposite shows which properties and vendors are likely to provide higher allowances. As there are always exceptions to the rules, it is still useful to consider each project on a case-by-case basis.

Capital allowances must be considered as early as possible during the sale and purchase process. Generally, it is the party that mentions it first in the heads of terms that ends up in the best capital allowances position post-sale.

If time is of the essence and there is a concern that the capital allowances agreement may slow the transaction, wording can be agreed within the contract that the actual value of the allowances will be agreed post-contract (but within two years, to comply with legislation). If there is no such wording, it will be almost impossible to persuade a seller to transfer allowances post-sale unless further monies are paid.

If a buyer and seller forget to sign a section 198 tax election or are unable to agree, there is still a two-year window post-sale for parties to agree the quantum of allowances and sign an election. If an agreement is not forthcoming, there is a tribunal mechanism (section 187A of the CAA 2001). Given how HM Revenue & Customs (HMRC) and the Valuation Office currently interpret and apply the legislation on fixtures apportionments, it is likely that the buyer will benefit from the ruling and the seller will lose allowances where the property is sold for a profit (although there is partial clawback if sold for a loss).

It is therefore essential where sellers have made a claim that a section 198 election is included within the sale and purchase contract (and is correctly drafted and signed). A number of elections have been deemed invalid because they were not correctly written and/or completed. This election can be of any value between the original pool value and £2. The nearer it is to £2, the more allowances are retained by the client.

Residential property

While capital allowances are not available for individual house or apartment purchases, they can be claimed for communal areas of apartments and student accommodation, furnished holiday lets and serviced apartments.

Professional indemnity insurance

The 2014 fixtures rules are a potential professional indemnity (PII) insurance issue for lawyers – as the following example demonstrates.

An office construction is completed in 2014 by the investor Premium Offices (PO) for £100m. Due to a market slowdown, PO struggles to attract tenants, and interest deductions are significantly higher than rental income, so PO does not wish to pay a capital allowances adviser and no allowances are claimed. In 2017, PO sells the property for £150m to Tech Invest (TI).

The lawyers acting for TI ask in the CPSE whether capital allowances have been claimed. The response is no, and no other information is provided. The lawyers translate this to mean that it is not possible to agree a tax election as no allowances have been claimed, and advise TI accordingly.

This is a potential PII problem for the lawyers. Based on build costs of £100m, there could potentially be allowances of £30m which are lost to TI. They need to persuade PO to quantify and pool or claim the allowances. Further, they need to persuade PO to sign a section 198 election for an agreed amount. If TI discovers later they have been denied £30m of allowances by inappropriate advice, they may claim their solicitors were negligent.

If the seller is not chargeable to tax and therefore not entitled to allowances, the fixed value and pooling requirements do not apply. However, it is important to get a written statement from the seller advising that this is the case.

Historical purchases

For properties purchased pre-April 2014, the old fixtures rules still apply, so as long as previous owners have not made a claim, the current owner can make an unrestricted claim for the plant and machinery, as a proportion of the purchase price. It is worth reminding clients of this, as if they have not previously claimed, they can revisit their purchase and make a claim in the current open tax return.

Landlord contributions

An often ignored area of capital allowances relief is landlord contributions. If a landlord is chargeable to tax and is providing contributions to their tenants for fitting out their property, they should ensure that the agreements to lease correctly state who should benefit from any capital allowances that arise out of this expenditure. The agreement to lease therefore needs to state what the payment is for and that it should be apportioned first to general pool plant and machinery (to benefit from quicker tax relief), then special rate pool plant and machinery, and then only if there is further expenditure, to non-qualifying. It is also important to state that the tenant will provide cost information in order for this claim to be made. Without this explicit wording, the tenant could use the contribution for non-qualifying works, and the landlord would lose out on the allowances.

If you are acting for the tenant, this clause should be reversed, and state that the allowances will be used first for non-qualifying structural works (to ensure the contribution does not have to be treated as a reverse premium for HMRC), then special rate, and finally general pool.