Following the publication of their whitepaper, Simon Radcliffe, Head of GTS Claims at Law Society partner Liberty GTS, details recent mergers and acquisitions insurance claims trends and which deals are most likely to lead to a claim.

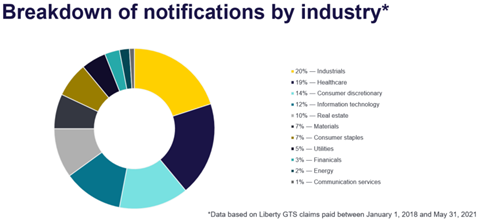

The Liberty GTS Claims Briefing for 2021 has recently been published. The claims briefing provides an in-depth assessment of mergers and acquisitions (M&A) insurance claims by industry, region and cause, and sheds light on the types of deals that are most likely to lead to a claim. In this article, we’ve looked at which industries are the highest risk, and why.

Two sectors dominate when it comes to claims. Industrials is the biggest, and within this the manufacturing sector. This year, there has been a cluster of claims in aerospace and defence, mostly relating to customer contracts. These types of businesses are often dependent on a small number of contracts. If a contract issue slips through the net during a deal, there is clearly the potential for a large claim.

In second place, healthcare businesses have been generating an increasing number of claims in the last few years, largely in the Americas, and many of these are large claims. We believe healthcare transactions must be examined under a heightened risk standard.

Many claims relate to billing or coding issues that have been triggered by audits or a whistleblower report. These can result in large claims and can trigger a government investigation. Other more recent healthcare claims have involved cybercrime. The sharp increase in the number of attacks reported means that deal teams will, in future, need to ensure that the underlying business has adequate cyber cover in place as part of their due diligence.

By contrast, businesses operating in the pharmaceutical, biotechnology and medical devices space are generating production-related claims, and these notifications have accounted for some of our largest claims in this sector. Interestingly, we have seen very few claims involving intellectual property issues, usually one of the most significant areas of focus during the due diligence process.

IT deal pricing pushes up claims

In 2020 there has been a noticeable uptick in claims involving companies in the IT sector, reflecting the increasing number of deals in this space. This has thrown a spotlight on high valuation multiples on deals involving young, fast-growing tech businesses. A high valuation multiple can obviously result in a large claim where the loss is calculated on a ‘multiple-of-EBITDA’ basis, even when the underlying issue is not particularly significant.

As a result, we predict that the market may increasingly look to cap the size of the multiple or even exclude the use of a transaction multiple altogether.

Education, real estate and food and beverage

One unexpected area of increased risk in the last year has been education (private universities and schools). These have involved a range of issues, including the lack of appropriate permits, unpaid tax, non-compliance with health and safety, and irregular enrolment practices. This suggests that this sub-sector may involve more risk than traditionally thought.

Elsewhere the big issues are different. In real estate, many claims are tax related, though we also see a high number of claims for lease and tenancy-related issues, meaning that deals involving retail sites generate more claims than deals involving office buildings. Other common issues include unpaid utility bills and disputes between landlord and tenants around fit-out costs. We are also seeing an increasing number of claims relating to health & safety issues, including non-compliance with fire regulations.

Finally, food and beverage claims have been a notable climber in 2020-21, particularly in Asia. This is partly down to the fact that this industry has complicated supply and distribution agreements. They are also susceptible to problems with obsolescence and spoilage. We have also seen wage-related disputes, reflecting the reality of a low cost, shift-based workforce. There has been an increase in consumer actions against food and beverage companies based on allegations of deceptive advertising.

So, while we see two sectors that need careful watching: healthcare and IT, there is no room for complacency in other industries which each have their own particular post-deal issues to watch out for.