For the last 20 years, we’ve undertaken an annual Financial Benchmarking Survey.

It’s the leading survey for medium-sized and smaller firms in England and Wales, providing participants with a bespoke report showing how their firm compares to similar firms.

To complement insights from the annual survey, we developed a quarterly pulse survey to provide a timely barometer of business conditions for small and medium-sized (SME) solicitor firms.

This paper reports on firms’ experiences of quarter three (Q3), 2021. 81 firms took part.

Main points from the Q3 survey

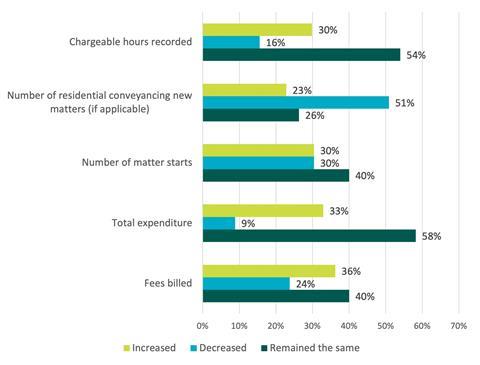

- General activity levels in the participant results in Q3 have decreased compared with quarter 1 (Q1) and 2 (Q2) results. Only 36% of firms reporting an increase in fees issued compared with 58% in Q2 and 52% in Q1.

- A smaller proportion of firms reported increases in chargeable hours in Q3, reflecting a declining profile of productivity in firms compared with those earlier in 2021.

- It was noticeable that there were significantly fewer firms reporting growth in matter starts and specifically residential conveyancing matter starts in Q3 compared to Q2 (in Q3 this was 23%, whereas in Q2 it was 66%).

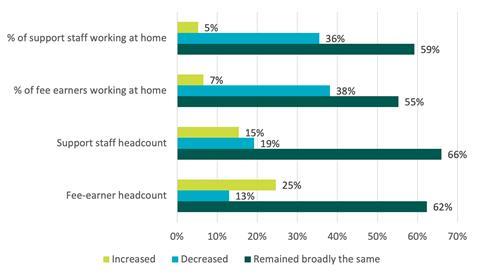

- Q3 results reflect a slowing in headcount growth in firms (both at a fee earner and support staff level). The results also report a trend of more fee earners and support staff returning to the office to work – in similar proportions across the two groups.

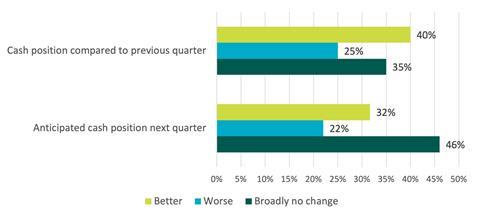

- In Q3, 40% of firms reported an improved cash position which is a less than Q2 when 58% of firms reported and improved position. This is probably linked to the lower productivity points mentioned above.

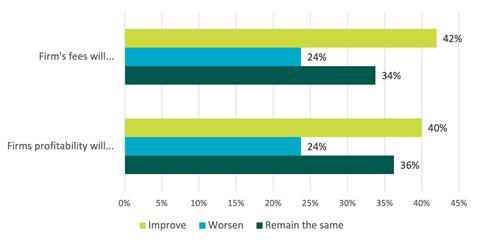

- Business confidence in Q3 also appears lower than Q1 and 2 with 42% of firms reporting an expected increase in their fees issued (Q2 54%) and 40% (Q2 49%) of firms predicting an increase in their profitability.

Income, expenditure and new work

- In total 76% of firms reported fees issued either remained consistent or were higher than the previous quarter. A similar patten was reported in relation to chargeable hours with 84% of firms reporting stability or growth in this statistic.

- Around half (51%) of firms offering residential conveyancing services saw a decrease in the number of new matter starts for this area in Q3 which appears naturally linked to the end of the SDLT relief scheme.

Staffing and office space

- For the majority of the 81 participating firms, staffing and office space had remained the same as the previous quarter.

- There has been an increasing trend of employees returning to the office with 36% of firms reporting a decrease in support staff and 38% reporting a decrease in fee earners working from home compared with Q2.

- 25% of firms reported an increase to their fee-earner headcount. No firms reported redundancies during the July to September quarter.

- Of firms with physical premises, 11% had reduced their office space and 6% anticipated a reduction in the next quarter.

Cash position

- 40% of the 81 participating firms reported a better cash position compared to Q2 but 25% reported a worse position.

- 22% of responding firms had anticipated a worse cash position compared to the previous Q2.

- Of the 49 firms (60%) which took a CBILS loan, 45% (22 firms) have used the loan.

Business confidence

- Businesses were confident in their outlook for the next twelve months, with around half predicting an improvement in firm’s fees (42%) and profitablity (40%).

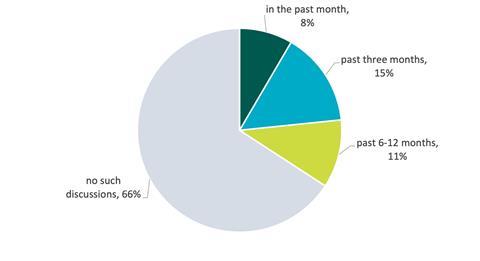

Merger, takeover or amalgamation

- 34% (1 in 3) of firms reported discussions regarding a merger, takeover or amalgamation in the past 12 months.

Have any discussions regarding a merger, takeover or amalgamation commenced in…

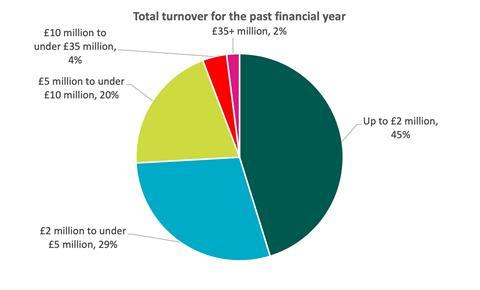

Participating firms in Q3

A big thank you to the 81 firms who took part in the first pulse survey. This survey provides insight into how your firm compares with other SMEs in the sector. The more firms that participate, the more detailed the insights we can feed back to you.

Quarter 4 and onwards

The Quarter 4 survey launching at the end of January will include questions on pay and recruitment.

If you have any comments on the content on survey or the report, please do get in touch. We are currently reviewing the questionnaire and report to ensure that we are collecting and presenting data that’s useful to you. (joanne.cox@lawsociety.org.uk)